46% of marketers feel that retargeting is undervalued, so should you be using it?

For us as marketers, the digital age is both a blessing and a curse. It is a blessing because it has never been easier to reach the target audience. It is a curse because everyone tries to capitalize on it. What we are left with is a highly cluttered digital environment and the battle to attract attention.

But to be fair, you are great at your job. You know all the little tips and tricks that will help your brand stand out online. So we will take a look at a method that most consider old hat - retargeting.

Retargeting, sadly, is a trick that 46% of marketers feel is woefully unvalued. Is it because it is an older trick? Or perhaps because it is not well understood?

In this post, we will go through a quick recap of what retargeting is. We will then move onto a practical example of how to retarget an ad on Facebook.

What is retargeting?

Retargeting is where you place a pixel or line of code on one of your site’s pages. When someone visits that page, the code will track their movements. When they leave your site, it will automatically display your adverts on different sites or social media.

You’ll have noticed examples of this yourself. Ever noticed that when you leave Amazon, items that you looked for start appearing in ads on Facebook, Google, and so on? That's an obvious instance of a retargeting campaign.

Why bother?

Most shoppers need a few touchpoints before choosing to buy. By presenting them with relevant advertising off-site, you are reminding them of the product or brand. They feel more familiar with it because they have seen it so often they are more likely to buy.

What’s more, they begin to associate your brand with that particular item. Even if they’re not quite ready to make a purchase just yet. When they are, your company will be at the front of their minds.

Creating a Facebook Pixel

You are allowed to create as many as 100 pixels per Facebook business page. Using the Business Manager on Facebook is the ideal way to do this. Especially when:

- There is more than one person managing ads on the platform.

- You have a few sites or primary business lines.

- You want to get some stats before you start advertising.

To use the Business Manager, you must:

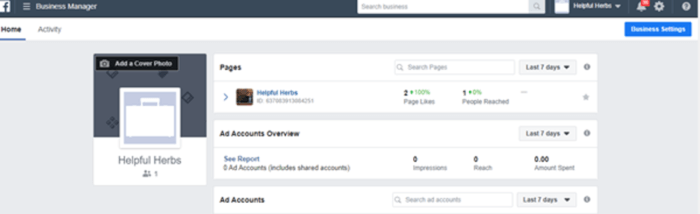

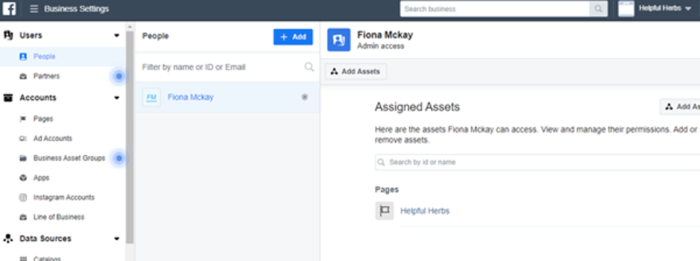

- Create a Business Manager account.

- Ensure that you are the admin.

Creating Your Pixel

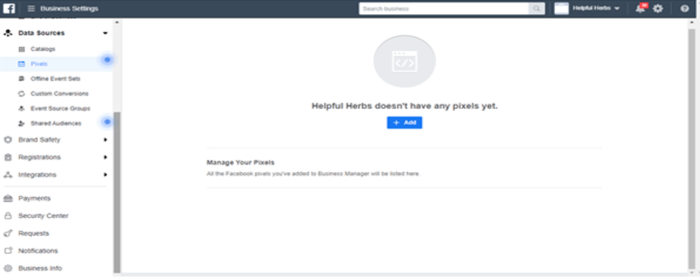

For the purpose of this exercise, we will use a throwaway account on Facebook.

- Open your Business Manager, click on “Business Settings,” and select your business.

- Click “Data Sources.”

- Select “Pixels.”

- Click “+ Add.”

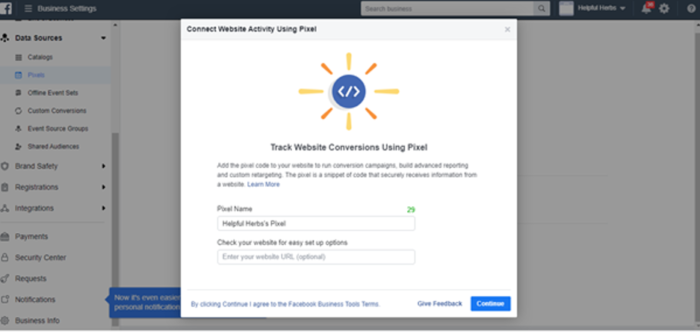

- Choose a name for the pixel. It can be anything you like. If you are going to have a few, it might be worthwhile naming them for the specific page or the campaign goals. As long as you can distinguish one from the other, you are good to go.

- Put your site’s URL in. That is not entirely necessary, but why not do it anyway.

- Hit “Continue.”

- You’ve now created your pixel.

What next?

Head over to your website and insert the code on the page that you want it on. If you want it to appear on every page, it has to be placed in the site’s head section. Just one more step and we’re done.

Now go back into your Ads Manager. Find the button saying, “Send Test Traffic.” Give it about half an hour or so. When the test is complete, you will see that the status says, “Active” - and now you are done!

Quick Win – How to do Facebook retargeting

Learn how to find and promote yourself to advertising to segments that will benefit your business, use Facebook Pixel, set up dynamic ads, and improve your retargeting tactics.

Access the How to do Facebook retargeting

Where to put the Pixel?

Most people think that creating a pixel is the hardest part. If only that were true. In reality, the hardest part is finding the optimal spot to place the pixel. When in place, you can track just about any action you like.

Here are some examples:

- If someone subscribes to your newsletter.

- When someone abandons their cart.

- If someone buys something.

- When they look for something on your site.

To start off with, choose between one of the following:

- Someone visits your site - Some companies do this. It is a simple strategy. The problem is that the pixel will then track anyone who visits the site. That is anyone who lands there by accident, clicks off fast, or those who search the site.

- Inline action - This is where you make the pixel active only after your visitors perform a particular task. For example, when they abandon their cart. This is a more effective way of getting sales because the client has shown definite interest.

Increase effectiveness by carefully targeting the Pixel

Use the power of Facebook to your advantage here. You can create up to 100 different pixels, so why not use these to create more targeted advertising?

Say, for example, that you sell kids products – toys, diapers, and so on. Your site will be visited by parents and kids old enough to use the internet. The mother may visit the site to check out the game the son has been nagging for. She may also want to look at educational toys, baby supplies, and so on.

That’s where creating a more targeted pixel will come in handy. The eleven-year-old son is interested in the game, and possibly games like it. He’s not going to be interested in the latest special on diapers.

When creating your pixel, you could create a target group of 10 to 15-year-olds. Get even more specific by adding interests such as video gaming. Your pixel could then trigger an album of products related to the game. You could have the game, expansion packs, action figures, posters, and so on. You get the idea – you’re catering to the fanboy in the child.

This approach would likely fall flat for the mother. She might consider buying her child the game, but she’s not likely to be interested in action figures, posters, etc. Maybe her ad should show game bundles instead – she doesn’t have time to sort through all the paraphernalia out there, so this is a nice shortcut for her.

You could take it one step further. What about educational toys, or a quick selection of books suitable for tweens?

Retargeting can be as specific or as generalized as you like. Guess which approach leads to better results.

Final notes

There are several strategies that you can employ using pixels. Why not retarget people who bought a specific product? The ad could be related to what they have already bought, or try chasing after that abandoned cart.

There is no end to the creative strategies that you can come up with now that you understand how to create and place a Facebook pixel. What are you waiting for?

Andriana Moskovska is a content curator and contributor at

Digitalmarketingjobs.io. With a passion for tech and marketing and a degree in English Language and Literature, she always manages to deliver well-researched and impeccably written content. When she’s not writing her next piece, you can find her immersed in some of the classics, or planning her next trip.