Google starts tracking credit card transactions to assess online ads effect on online and offline sales.

Every marketing manager has always sympathized with John Wanamaker's famous phrase "Half the money I spend on advertising is wasted; the trouble is I don't know which half." Digital marketing has helped alleviate some of the problems of attribution, by tracking of digital media. But unless someone is clicking through to purchase on your site or tracked by call they make via the site, it's very hard to attribute offline store sales to a particular online ad campaign.

But this limitation is now reduced which is BIG news for multichannel retailers. Yesterday Google announced it is now tracking consumers card transactions both online and in-store. The ability to track in-store sales is a real breakthrough in attribution, as since 92% of all US retail sales still take place in-store. Without it marketers are limited to focusing all their attribution offers on just 8% of total sales.

Google currently capture 70% of credit card and debit card transactions, by working with various partners. Google have said that they've developed their own encryption technology to ensure that users card details are kept totally secure. Privacy campaigners are understandably not happy about the measure, as it puts more knowledge of customers purchases into the hands of brands. But for marketers, it is sensational news.

This ability to track the effects of online ads right through to sale, no matter what channel it takes place on, really is the holy grail of online advertising. It will revolutionize marketers ability to show ROI, and will allow for testing to optimize sales without discriminating between online and in-store conversions.

Will Google know what I've bought?

Google has spent years developing new encryption technology so that they'll be able to show when ads are effective, but no one (including Google) will know what individual customers have bought.

The mathematical formulas convert people’s names and other purchase information, including the time stamp, location, and the amount of the purchase, into anonymous strings of numbers. The formulas make it impossible for Google to know the identity of the real-world shoppers, and for the retailers to know the identities of Google’s users, said company executives, who called the process “double-blind” encryption.

This should asway public fears of brand being able to know exactly what they've bought and when, which could be intrusive. We don't yet know if there will be additional government regulations applied to this technology, restricting what marketers can and can't do with the data.

How can I use this data?

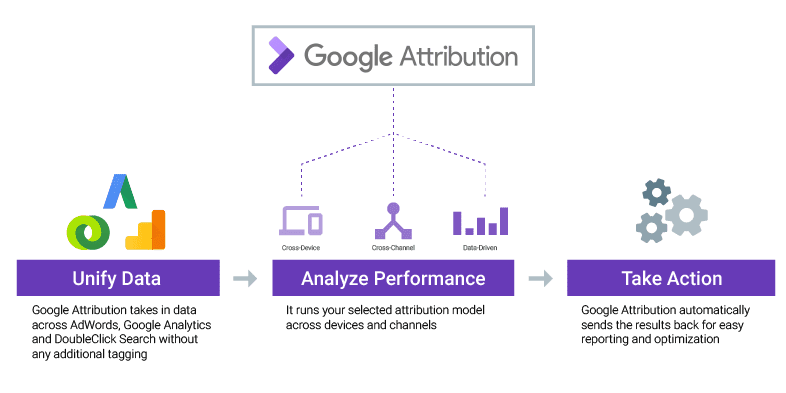

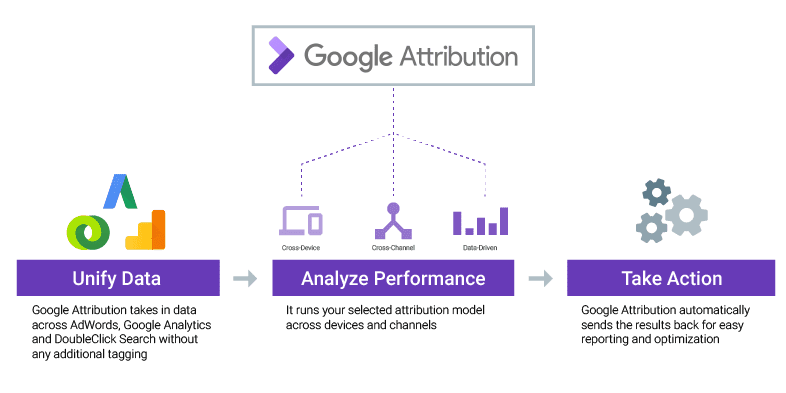

Google so far has only announced that it has the ability to track this data. It hasn't announced what Google product the capability will be built into, but it is likely to be added to its new 'Google Attribution' tool. This was launched only two days ago to help advertisers bring together data from Google Analytics, Adwords and DoubleClick. The aim is to give users a full view of the customer journey, rather than just focusing on last click attribution.

This used to be part of Google's expensive enterprise solution '360 Suite', but now a free beta is available to anyone who wants to improve their attribution. Marketers interested in improving their online and offline attribution should get step on the platform, and stay tuned for more updates on how to utilize Google's new ability to track card purchases.