Are you benefiting from the latest sector innovations in your healthcare business' marketing strategy?

We are now in a period of significant change for healthcare marketeers, as digital developments continue to increase the importance of both digital communications and value delivery in healthcare.

Now, businesses need to continue to innovate their business models to make their online experiences and customer engagement communications even more effective, to attract and retain healthcare practitioners (HCPs) and consumers amidst uncertain/disruptive times.

In our future of digital marketing trends report, we focus on how innovations in digital communications can support brand marketing and sales teams to communicate these new value propositions.

Disruption and change management

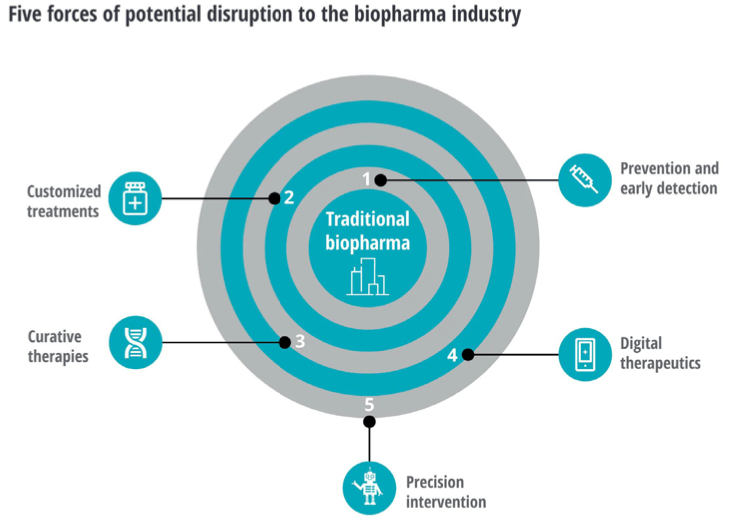

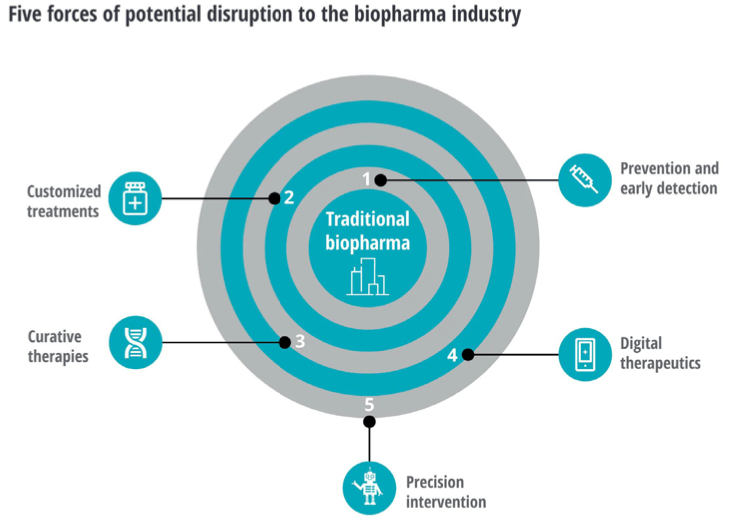

The authors of The future of Biopharma highlight trends of disruption within the biopharma industry specifically. This disruption is a result of a shifting power balance in two primary directions.

The first shift is in the balance of power across the healthcare value chain, as governments and insurers take center stage, pressuring pharmaceutical companies to reduce prices and demonstrate greater value from their therapies.

Secondly, the swing from treatment to prevention, diagnostics, and cure, will grow stronger in time, attracting a host of new entrants from within and outside of the sector.

The result is five sources of disruption that prevalent not just for biopharma but across Healthcare marketing too, as we will see from the trends being outlined below.

1. Prevention and early detection:

Treatment for some diseases could be rendered no longer necessary with continued improvements in wellness and vaccine technology. Interventions that halt diseases in their earliest stages will be possible with continued advances in early detection methods - thereby preventing their progression to becoming more serious conditions.

2. Customized treatments:

'Big data' powered personalization could help match patients with tailored therapies or custom drug combinations - avoiding a 'one-size-fits-all' approach to treatment.

3. Curative therapies:

Similar to preventative approaches, curative therapies could reduce or even eliminate the usage of some prescription medicines. To achieve this, the biopharma sector will likely need to invest in and adopt new capabilities to develop, market, and assign appropriate pricing structures.

4. Digital therapeutics:

Medication demand could be reduced or eliminated through the appearance of increasingly effective and scalable nonpharmaceutical (digital) interventions such as those focused on behavior modification.

5. Precision intervention:

Robotics, tissue engineering, or nanotechnology could reduce the need for pharmaceutical intervention.

4 emerging trends in healthcare marketing

Amongst the disruption we have seen in 2022-23, four emerging trends have taken center stage in healthcare marketing, promising to revolutionize the industry in 2024: Digital engagement, Telehealth, e-detailing, and Direct-to-Consumer (D2C) approaches.

These trends are not only reshaping how healthcare is marketed, but they are also redefining how patients and consumers interact with the healthcare sector. By examining these trends, we uncover insights into their impact and benefits as well as the implications for the future of healthcare marketing.

1) What is digital engagement?

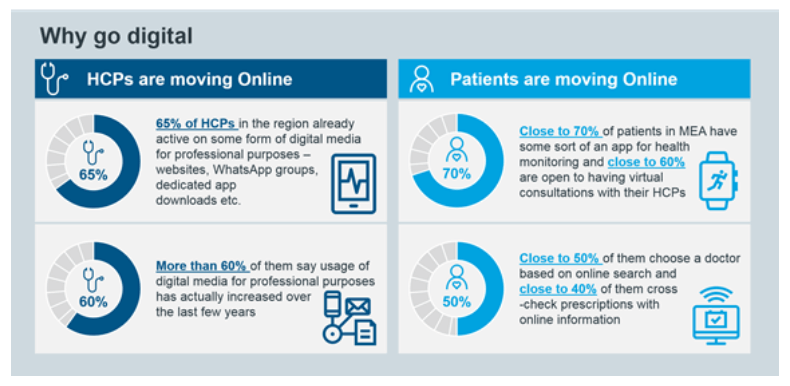

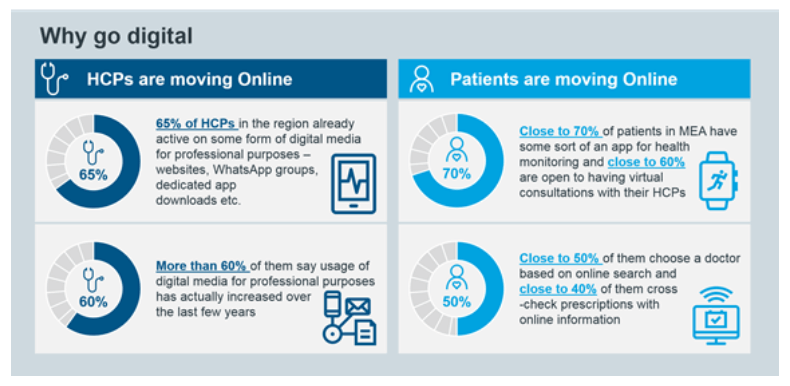

Evolving digital capabilities have enabled healthcare practitioners, providers, and patients to proactively connect with, understand and support each other.

This can be over passive channels like emails, SMS, banner ads, or interactive channels like chatbots and apps, etc., through the use of light content (ads, banners) or rich content (games, articles).

IQVIA believes that digital engagement provides the value that HCPs and patients seek across dimensions and it has opened many opportunities for pharmaceutical companies to interact directly with HCPs and patients.

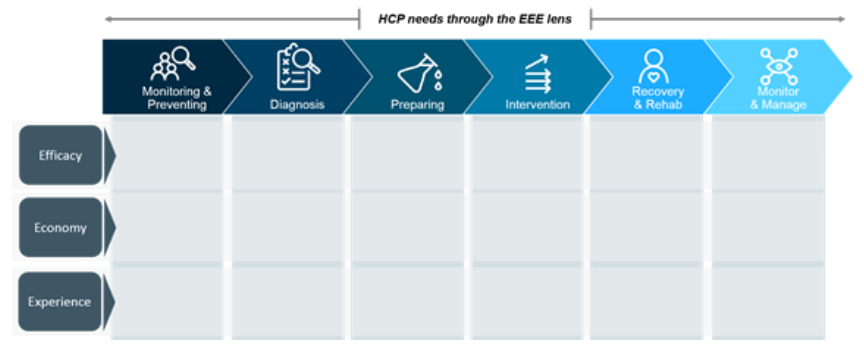

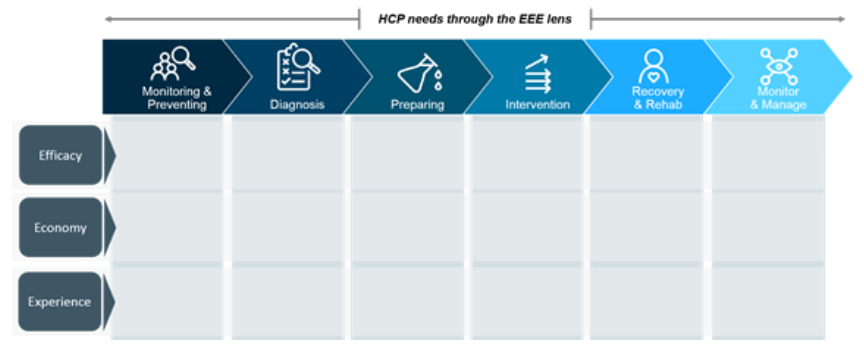

They go further to suggest aligning the customer journey around the cardinal outcomes or ‘three Es’ which in the context of healthcare are:

- Efficacy – trying to maximize health outcomes, quality of cure, and recovery.

- Economy – trying to minimize time and money spent on treatment and recovery.

- Experience – trying to minimize emotional anxiety during the care journey.

2) What is Telehealth?

Telehealth is an all-encompassing term that is used to define the provision of medical and healthcare services that are accessible virtually. This can be by Type (Products and Services), By Modality (Store-and-forward (Asynchronous), Real-time (Synchronous), and Others), by Application (Teleradiology, Telepathology, Teledermatology, Telecardiology, Telepsychiatry, and Others) or by End User (Healthcare Facilities and Homecare).

Telehealth has emerged as a powerful tool with many people actively adopting teleconsultation and remote monitoring services in order to receive services while adhering to social distancing protocols. This is a technology and medical solution that’s here to stay, has a far-reaching impact on medicine and healthcare, and provides opportunities for marketing too.

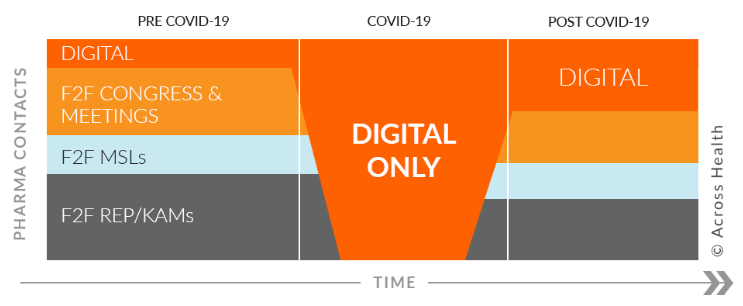

The past year has highlighted the importance of protecting healthcare services and individuals and as the pandemic raged across the globe, telehealth and remote patient monitoring (RPM) solutions became increasingly relevant. Their value was highlighted by the need for a rapid shift from contact-based care to virtual and the need for patient support in multiple locations and situations. The market also shows that telehealth and RPM are here to stay.

3) What is e-detailing?

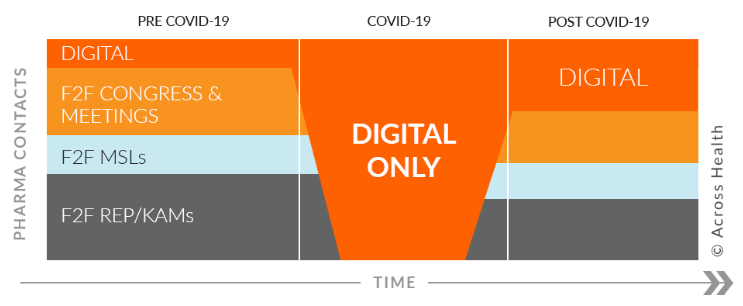

E-detailing, electronic detailing, is a now well-established way of increasing pharmaceutical and MedTech company efficiency in customer engagement – and enables better service to be delivered to healthcare professionals (HCPs) and other stakeholders.

You may already know that e-detailing is information concerning things like newly marketed drugs, services, and technologies or sales content provided on a mobile device. The key is to make sure the content that is provided this way is interactive, interesting, and useful for HCPs. Because the presentations are trackable, they can provide data to help you better meet HCP needs in the future.

Remote e-detailing

With access to HCPs becoming harder and the social distancing requirements in place due to COVID, remote e-detailing is growing as a necessary way of connecting with customers. By taking the physical detailing meeting online, pharmaceutical representatives and medical science liaisons are able to quickly schedule appointments when they are most convenient for HCPs.

Having quality, credible content is important and this needs to fit within the journey physicians embark on when they consume information.

When considering your ideal solution you may need to consider these aspects of your content:

- Are you willing to adapt the content you already have to match specifically the needs of the intended audience rather than general consumption?

- Can you provide this adapted and focused content on the digital platforms that my segments actually engage with?

- How will you ensure your content is updated regularly?

4) What is direct-to-consumer (D2C) in healthcare?

Digital media and technology targeting allows marketers to continue building relationships with healthcare professionals (HCPs), but also launch new consumer-facing marketing campaigns, where the direct-to-customer (D2C) model is becoming more important.

D2C means brands can communicate their proposition and, in some cases, deliver their services, directly to customers via digital media channels such as website content with content distribution achieved through search engines, digital ads, social media, and email automation.

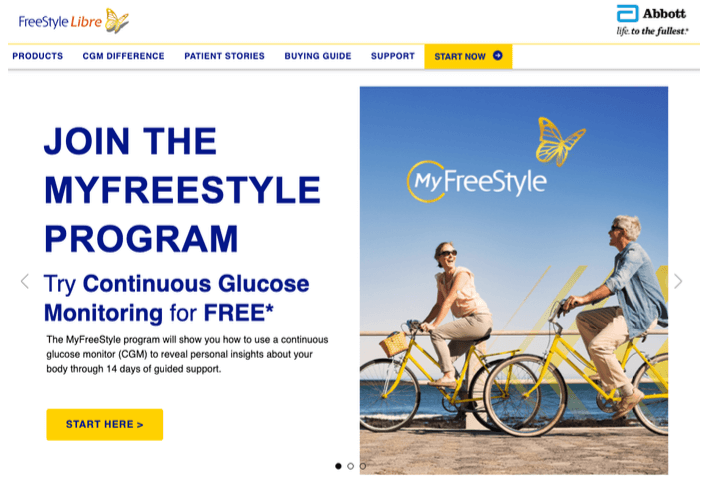

A D2C example from the Pharma sector is where Abbott introduced Freestyle Libre, a consumer subscription commerce option to improve access and loyalty for its diabetes care devices. This service uses many of the approaches of Software-as-a-Service or (SaaS) platforms to test and improve customer conversion rates and loyalty.

D2C product/service launches

When launching such new D2C services digital media and technology will become more important within campaign communications to reach and persuade consumers as they decide on adoption independently or with HCP support.

Reviewing the quality of orchestrating always-on marketing communications across paid, owned, and earned media will also become more important to ensure the right types of digital and traditional communications are used across the entire customer lifecycle model.

Get more advice on how to apply D2C strategies or any of the trends covered in this blog in your own healthcare marketing strategy when you download our Free Members' report: The Future of Digital Marketing Trends.

Download our Free Resource – The Future of Digital Marketing trends report

Download our future of digital marketing report to benchmark your marketing across the 7 pillars of digital marketing and 400+ marketers.

Access the Future of Digital Marketing 2025 trends report

Away from the trends: Always-on marketing communications for healthcare

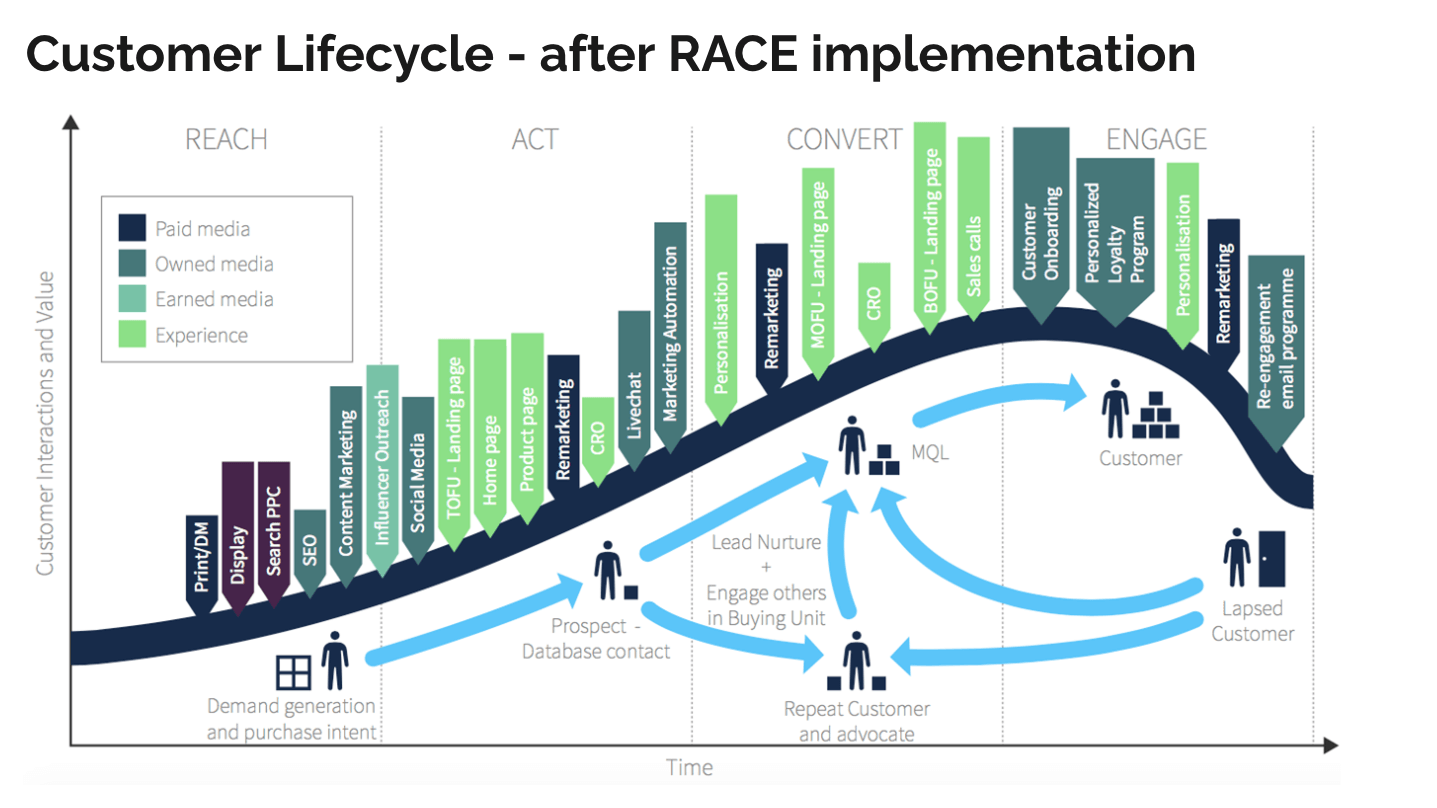

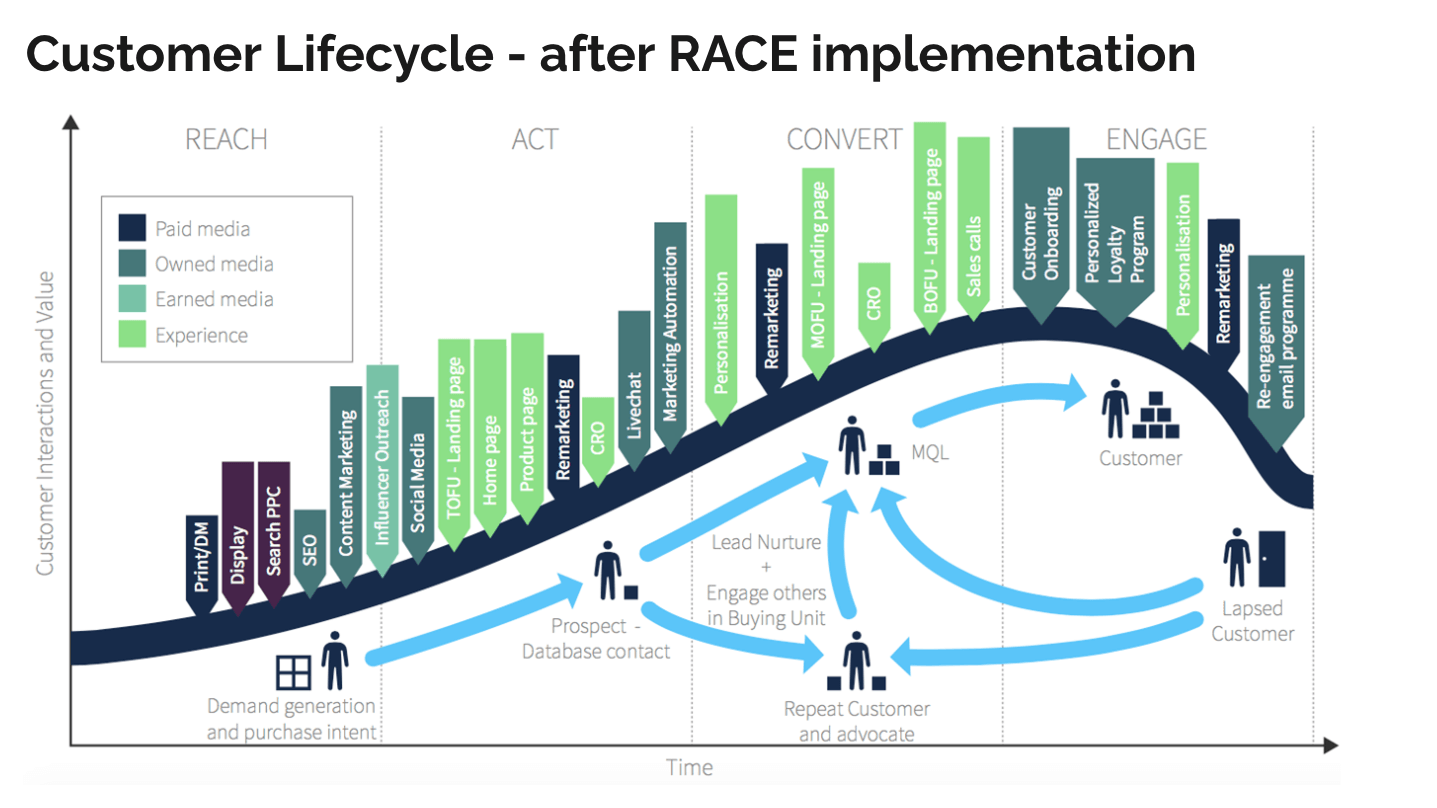

At Smart Insights, we recommend implementing a planned approach to scheduling and optimizing continuous marketing activities that support customer acquisition and retention. These activities aim to maximize visibility and persuasion through the customer lifecycle.

Key ‘always-on’ activities include paid and natural search marketing to increase visibility as visitors search for products, information, or entertainment; social media and influence marketing to encourage recommendations.

Once visitors are aware of a brand, their interest can be nurtured by marketing automation techniques to feature persuasive content marketing including email marketing, SMS messaging, or push notification plus on-site personalization and off-site re-targeting ads.

This example summarises B2B lifecycle AO communications across the Smart Insights RACE planning framework suggests the complexity of communications that need to be planned, managed, and optimized.

The bigger picture: How to position your healthcare value proposition?

In a period of rapid change, it can be useful to review your positioning also. Across healthcare, three approaches to marketing have been identified by KPMG.

The active portfolio company

This is typically a company that is active in several therapeutic areas within its portfolio. An example would be companies that operate in genetics or immunotherapy - as they are constantly searching for new therapies as well as reappraising their current product mix to help match unfulfilled needs. As the number of blockbuster drugs protected by patents is continually decreasing, an active product lifecycle management approach becomes all the more critical.

The virtual value chain orchestrator

This approach possesses significant opportunity, effectively able to guide patients through a complex healthcare value chain, supporting healthcare practitioners to provide tailored care, and even enabling pharma companies to be paid based on outcomes - all over the patient's lifespan. This presents significant sector change, whereby a company could effectively 'own' a customer but creating one-stop healthcare platforms. This essentially turns health into another consumer choice - where a platform owner covers the entirety of the patient's needs, such as advice, monitoring, and treatment of varying and tailored levels of complexity.

The niche specialist

This means those that typically specialize in treating a condition in its entirety, not those that offer a single type of treatment. A good example would be an arthritis specialist - they can treat symptoms and also provide a host of outcomes that aim to improve the arthritis sufferer's lifestyle, such as offering support splints and comfortable shoes to lessen the impact on painful joints.

The state of healthcare marketing trends in 2024

The trends reported above represent a dynamic shift in the industry's approach to reaching and connecting with patients and consumers. Marketers now have, at their fingertips, digital tools and techniques that can engage patients and healthcare practitioners across healthcare products and services with unparalleled convenience and accessibility.

By staying attuned to these developments and harnessing their potential, healthcare marketers can better meet the needs of their patients and clients, ultimately contributing to a healthier and more interconnected world.

For more help identifying and prioritizing digital marketing trends to inform your strategy, don't miss the 2024 edition of The Future of Digital Marketing, exclusively for Smart Insights Free Members only.

Download our Free Resource – The Future of Digital Marketing trends report

Download our future of digital marketing report to benchmark your marketing across the 7 pillars of digital marketing and 400+ marketers.

Access the Future of Digital Marketing 2025 trends report