Direct traffic is a great indicator of brand strength - marketers should consider its use as a KPI

How a brand drives its traffic in the online arena is one of the most important things for any digital marketer to know. These traffic drivers can be divided broadly into these 7 segments

- Direct

- Mail

- Referrals

- Social

- Organic Search

- Paid Search

- Display Ads

Each has its own implication on a brand’s online presence however for the scope of this article we will focus on Direct Traffic vs. Various Search metrics.

Direct Traffic is when a consumer directly types in the name of a brand’s website in the address bar.

Search Traffic is when a consumer is looking for information about a brand and its services/products via a search engine or directly inputting the name of the brand or its product/service, in a search engine.

Before we begin it is worth mentioning that a lot of the recall value of a brand cannot be connected with the direct traffic metric as a lot of people usually search for a brand name via search engines as well. For example, even if one is fully aware of what Yelp is or offers, people will still search for it via Search engines rather than directly visiting the website. This is primarily because they may want precise results of restaurants without having to go through the hassle of searching once they are on Yelp (in this case). This kind of a situation is excluded from the scope of this article as this defines consumer behaviour towards a brand which is a whole new topic all together. A strong brand which is not able to drive traffic to its website via its own brand name is a problem worth mentioning however it is a moot discussion in this case as this article considers direct traffic to be a very good indicator of brand recall and awareness. This aritlce will show that Direct traffic is the ultimate metric for defining brand strength, awareness or recall in the online realm when it comes to traffic share analysis.

Let’s move on to the fun stuff and compare well known brands to see their traffic share and to define their brand strength, awareness or recall.

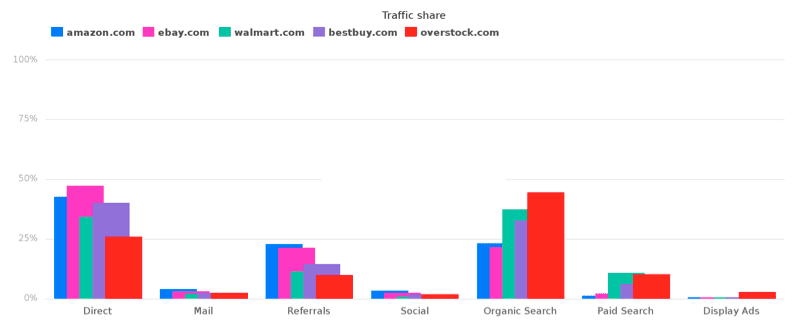

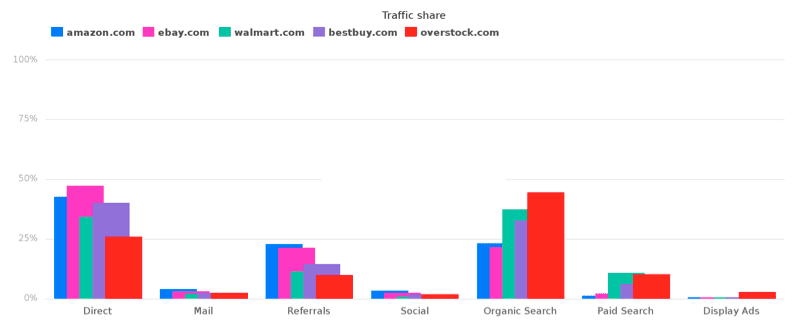

Online Shopping Sector - USA

Ebay has the strongest graph when it comes to direct traffic, closely followed by Amazon. Overstock’s organic search traffic is the most and direct traffic the least as compared to its competitors. This is indicative of a developing brand in the sector. This is further confirmed by Overstock leading the display ad traffic segment and closely following Walmart in paid search traffic segment. Visual aid is always a good support structure for developing brand recall. (Remember the traffic driven to these websites on a daily basis is in the millions therefore we have a significant sample size). A strong brand here should correlate with direct traffic values. The consumer is likely flock to either one of Amazon, eBay, Walmart, Best Buy or Overstock for all their online shopping needs.

Key Takeaway:

Ideally during the journey of a brand from inception to maturity, the graph will shift from high paid search traffic, to organic traffic and subsequently to high direct traffic. The high direct traffic goal hasn’t been achieved by many brands because of the simple fact that consumer behaviour online dictates that most people usually “Google” things even if they already know about them. Google acts as a grocery store or hyper mart of sorts that stocks all brands and when people come to visit asking for various items, it suggests the best ones. In the online realm if one is to buy a shirt they would also go through a range of shops in a mall or in a particular shopping arena only to decide on the best fit, style, comfort etc. However if one were loyal to a brand then its strength would show simply because they would put the brand at the top of their consideration set during discovery or purchase. This consideration set can be figured out based on organic search and direct traffic metrics. If a brand has high organic search and direct traffic metrics rather than referrals, social, mail or paid search metrics then it can be considered a strong brand in terms of awareness and recall both.

However it can be established that some brands have transcended these metrics and established themselves as leaders in direct traffic share and these are the truly valuable brands in the online realm, these are the truly developed brands and these are the brands that have become verbs.

Note: We are excluding Google itself from our analysis since that would be highly imprudent for obvious reasons. All hail Google!

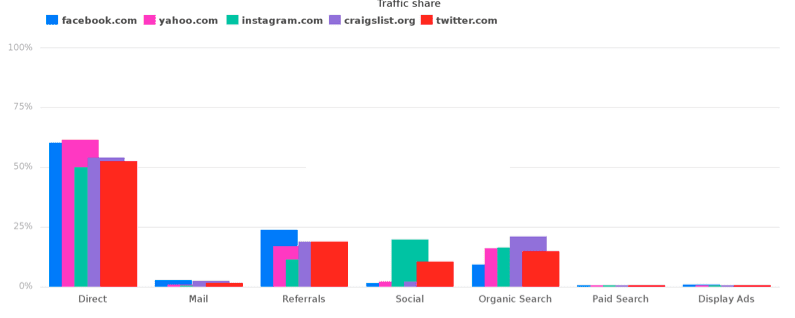

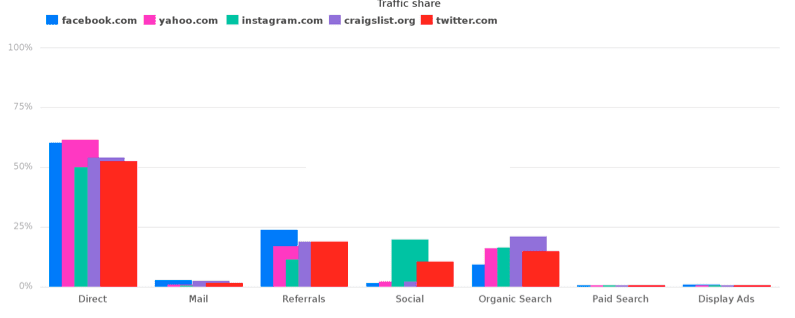

Strong Brands - Global

Direct traffic share is towering significantly above the rest of the traffic drivers. All the brands above are operating at above 50% direct traffic share. Yahoo and Facebook are in close competition at around 61%. This shows the recall value and also awareness that these brands hold in the minds of their consumers. (Again please note that traffic values are in the millions per day therefore highly significant numbers).

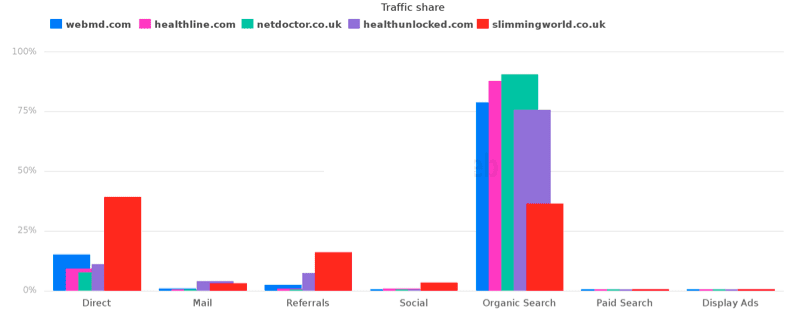

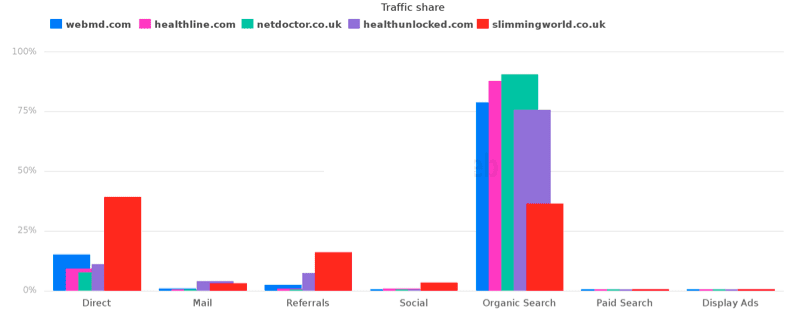

Health News - UK

The health news sector is also dominated by organic search traffic just as the online shopping sector was in the US. In this case it is even more so as most medical knowledge related information is always “searched for” as per prevailing consumer behaviour in today’s day and age. Even though WebMD is a strong brand, there aren’t significant sections of the population that are directly reaching it in order to make it a strong brand online.

This is the “normal” in this realm and it is doubtful that it will ever be overcome as these sectors are playing within the perpetual information discovery phase of the audience. Ideally, a strong brand in this sector should have very high direct traffic, strongly indicating that people trust this brand to give them the best of everything. In this case the best fitness news, disease prevention advice, drug related information, the best user experience or anything else a consumer thinks is worth their time and effort. This is also called “brand equity”, this is what the consumer is willing to forego when it chooses one brand over the other but this will never be the case here.

Defining Benchmarks

Therefore it is best to define metrics of how much direct traffic is considered strong brand awareness and recall. From the online shopping and health news graphs it can be seen that neither one of the strongest brands in the sector reach anywhere near the 50% value, in-fact most of them are operating under 40% . It remains to be seen how these graphs will play out over the next couple of years- whether they’ll go up or down is pure conjecture at this point in time. However, at current values when these brands have spent a significant amount of time and money and crossed the “paid search” stage of their online brand presence, it can be safely said that anyone in the health news & Online Shopping sector should consider 40% direct traffic as a benchmark of branding success in their own geography of operation.

It is also safe to say that neither the health news sites nor the online shopping websites will ever cross the 50% limit of equilibrium between direct and organic traffic purely due to consumer behaviour in the sector.

So far we have only analysed the developed brands, now let’s take examples of developed and developing brands both at the same time.

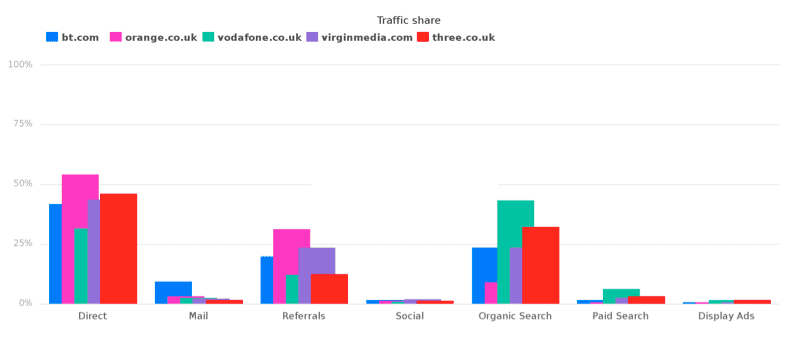

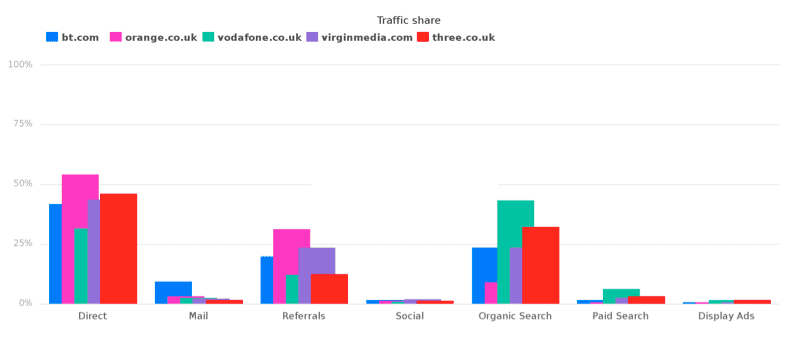

Telecommunications Sector UK - Developed

Let’s try and understand which of the telecommunications providers in the UK have a better brand awareness/recall in the online realm, using the method described above.

Orange is leading brand awareness and recall based on the 54% direct traffic values as compared to only 5% organic search values it is registering online. Vodafone UK has a high organic search metric, it seems they have caught on to this and are trying to increase brand recall and awareness with the help of paid search and display ads. Virgin media and British Telecom have similar direct traffic and organic search parameters of around 45%, with similar organic search metrics of around 24%. The graph is representative of the benchmark definition and the overall view of this article, as it can be successfully established that the developed brands are showing the right kind of direct traffic metrics as compared to the organic traffic.

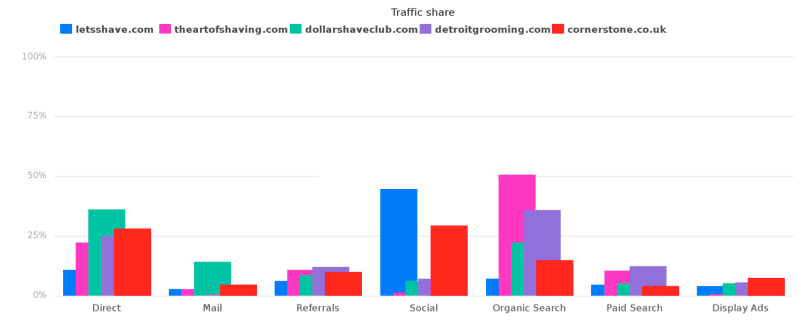

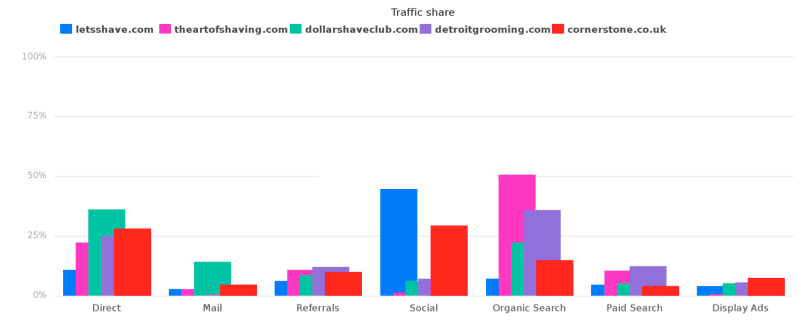

Online Men’s Grooming Sector - US & UK

All types of traffic generation techniques are in play here and the sector is highly competitive. Even mail campaigns are at a high (even 5% for mail campaigns is considered high traffic). Referrals, Social Traffic, Paid Search, Display ads all are being invested in. This is a very good way to identify a developing sector and brands in their development phase. When a traffic share analysis shows that almost all 7 methods of traffic generation are being utilized at some level or the other, the industry is nascent and brands are trying to position themselves as best as they can. In this case a strong social positioning strategy can be seen clearly.

Conclusion

The idea of the article was to establish traffic share analysis as a method to differentiate a developed brand from a developing one, by looking at direct traffic and organic traffic metrics as compare to the rest. It is safe to say that this has been established by analysing the many industries above. It is imperative that digital marketers keep this in mind when describing brand journeys for their brands in the online realm.

Thanks to

Akshat Misra for sharing their advice and opinions in this post.

Akshat is an independent marketing consultant with experience in market research, data analytics and digital marketing. Having worked with some of the biggest brands in the world and helping them set up their digital marketing efforts he has now branched out on his own to help the smaller entities that do not have access to the kind of resources available to the bigger brands. You can connect with Akshat on

LinkedIn.

Thanks to

Thanks to