Six key findings from the Global Reviews UK Home Insurance Providers Digital Marketing Effectiveness Study Q3 2014:

In Q4 2014, Global Reviews conducted a Digital Sales Effectiveness (DSE) study amongst twelve leading UK home insurance brands including Admiral, Aviva, AXA, Barclays, Churchill, Direct Line, Halifax, Lloyds Bank, LV=, More Th>n, Nationwide and Tesco Bank.

The aim of this study, which is part of Global Reviews’ ongoing programme of research, was to find out how consumers are choosing particular home insurance providers online, to understand and measure their digital journeys, and the key influencers in their buying decision. By capturing digital marketing and sales journey insights, underpinned by scientific framework using competitor and customer data for the sector, this research unravels some interesting facts for this insurance industry to answer many of the 'Why Questions'.

Over 280 ‘in market’ consumers looking for home insurance in the next 90 days were studied as part of this research, and here are some of the main findings.

Here are six key findings from the UK Home Insurance Survey

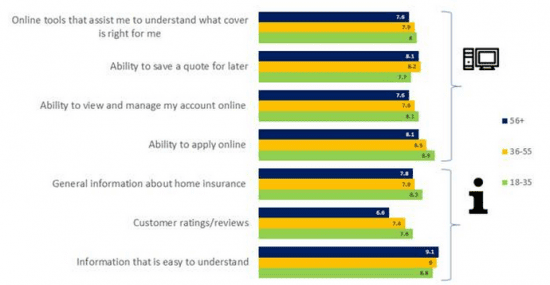

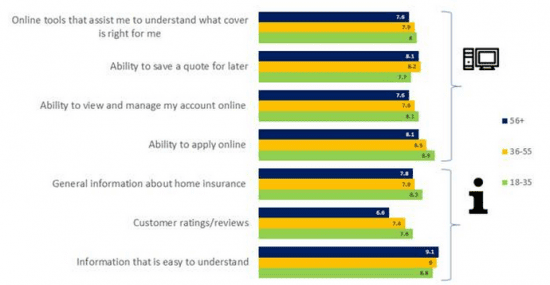

1. Generation Y want different things from their home insurance provider online

As part of our analysis we segmented the sample into three different age groups: 18 – 35, 36 – 55 and 56+ year olds.

Fig 1: Age differences driving preferences

Source: Global Reviews UK Home Insurance Providers Digital Sales Effectiveness Study 2014

In general those in the 18 to 35 age group are more demanding and are more likely to want:

- tools that assist them in understanding which home insurance cover that is right for them.

- the ability to view and manage their account online.

- general information about home insurance

- customer ratings and reviews.

2. Home insurance providers need to work harder to acquire first time customers

This group 'Generation Y' is the future and the acquisition territory for most insurance providers. They are more demanding and expect more which gives a good indication of where the industry needs to be playing in order to attract these younger customers.

It’s probably safe to assume that the majority of customers in the 18-35 age group are buying their first house and looking to take out home insurance for the first time. The insurers that are seen to be working harder for them are more likely to succeed in acquiring their entry-level business.

3. Older customers still want easy to understand information

You might imagine that consumers over the age of 36 have bought home insurance many times and are more familiar with the language and insurance options. While that may indeed be the case, age and experience doesn’t necessarily translate into a lower propensity to want information that is easy to understand, in fact it is quite the opposite.

Older consumers want easy to understand information and the ability to save a quote when they are researching options. To optimise online conversion for this segment, insurance providers need to implement UX best practice to provide simple attractive design which is utterly utilitarian in nature

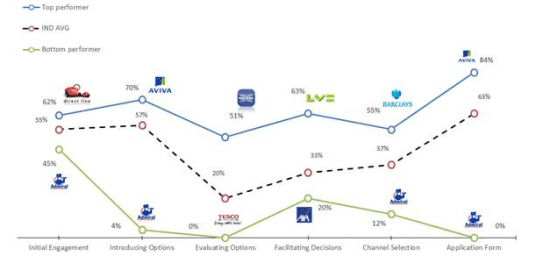

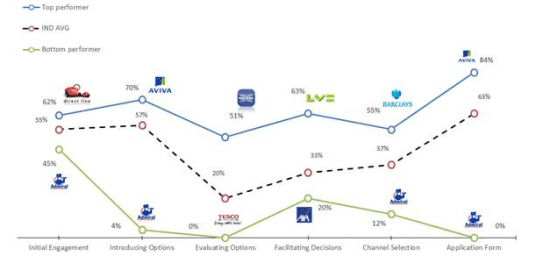

4. The home insurance industry as a whole is making it difficult for customers to buy from them online

The industry as a whole is particularly weak at helping customers to evaluate the different home insurance policies and choose which option best suit their needs.

The poorer performers across the online customer journey are Tesco Bank and AXA, with Admiral coming out weakest in four of the six stages of the online customer journey.

Fig 1 DSE benchmark scores

Source: Global Reviews UK Home Insurance Providers Digital Sales Effectiveness Study 2014

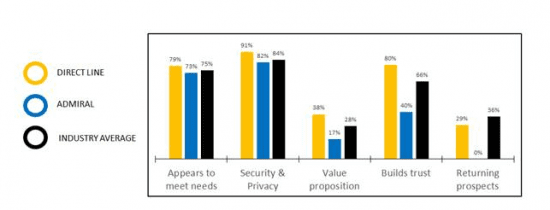

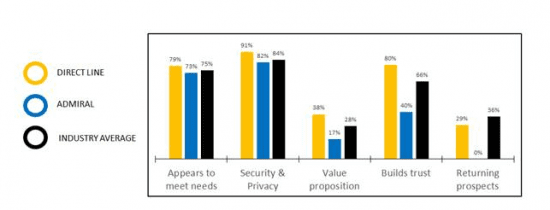

5. What’s driving Admiral’s score down?

Drilling down into the sub sections (Fig 2) you can see that there is a lot of work for Admiral (and indeed the industry as a whole) to do. Admiral needs to improve their value proposition (scoring just 17%), their differentiation message and explaining why a customer should choose Admiral over other providers.

'Returning prospects' scores 0% for Admiral, which clearly means that is not something Admiral currently incorporates on their site. Admiral also has quite a bit of work to do in the area of building trust.

Fig 2 'Meeting expectations and building trust' sub section of the initial engagement stage

Source: Global Reviews UK Home Insurance Providers Digital Sales Effectiveness Study 2014

6. What Admiral can learn from Direct Line

When we asked consumers to rate the home pages of the insurance providers, Direct Line’s homepage ranked much higher than Admiral’s because it displayed all the information they would expect to find when looking for home insurance. Plus consumers found that Direct Line’s homepage had a visual design that was appealing.

In contrast to this, consumers thought that the visual appeal of Admiral’s website was somewhat lacking as it looks a little 'child-like with its cartoonish characters' and quite a number of consumers found that the website was only geared towards car insurance.

Direct Line’s website uses both a lexical and icon based menu which increases the possibility of the consumer understanding the message which is being communicated. The website has clear signposting with a funnel process, which means that consumers intuitively know where they will be taken when they click a particular button.

The multiple use of the 'get a quote' call to action on the Direct Line homepage with clever placement of use of colour also increases success. As does the simple and clean design of the page which allow customers to understand very quickly what it going on and where to find what they need in order to move on.

If you would like to listen to my colleague Gerard Farrell, our Senior Client Advisor, walk you through both homepages listen to our recorded webinar from the 22:35 minute mark.

Through a proprietary, task based methodology; we invite ‘In market’ consumers to visit and experience the customer journey on your site.

We also measure the performance of your competitors’ sites in a similar fashion with a separate group of ‘In market’ consumers. This enables us to benchmark the performance of your brand within the marketplace and against the competitive landscape. We can tell you why some customers abandon the purchase journey on your website and complete purchase with a competitor.

We can provide you with a totally unique insight into how ‘In market’ consumers research and make decisions about your brand, your products and your competitors online and will help you to answer the following strategic digital sales questions:

- Is your online sales journey more effective at converting prospective leads than your competitors?

- Where do you need to focus resources to maximise online sales and customer experience?

- Does your website meet best practice customer experience design for that product purchase journey?

- How much effort is it to buy from you online?

Thanks to Marie Sheehan for sharing her advice and opinions in this post. Marie has 14 years' experience in traditional, digital and strategic marketing communications. She is the Head of Marketing (Europe) at Global Reviews. Global Reviews is a world leading online customer experience intelligence and digital research company provides companies with key customer insights on how to substantially increase their digital marketing effectiveness and digital sales outcomes, by helping companies measure, track and optimise their online and mobile sales effectiveness; by helping marketers understand the journeys and purchasing behaviour of in future customers and by providing marketers and digital specialists with up to the minute insights into what best practice online customer experience looks like around the world. Global Reviews’ clients include many of the world's leading insurance, energy, banking, travel, sports betting and retail companies. You can follow Global reviews on Twitter.

Thanks to Marie Sheehan for sharing her advice and opinions in this post. Marie has 14 years' experience in traditional, digital and strategic marketing communications. She is the Head of Marketing (Europe) at Global Reviews. Global Reviews is a world leading online customer experience intelligence and digital research company provides companies with key customer insights on how to substantially increase their digital marketing effectiveness and digital sales outcomes, by helping companies measure, track and optimise their online and mobile sales effectiveness; by helping marketers understand the journeys and purchasing behaviour of in future customers and by providing marketers and digital specialists with up to the minute insights into what best practice online customer experience looks like around the world. Global Reviews’ clients include many of the world's leading insurance, energy, banking, travel, sports betting and retail companies. You can follow Global reviews on Twitter.

Thanks to Marie Sheehan for sharing her advice and opinions in this post. Marie has 14 years' experience in traditional, digital and strategic marketing communications. She is the Head of Marketing (Europe) at Global Reviews.

Thanks to Marie Sheehan for sharing her advice and opinions in this post. Marie has 14 years' experience in traditional, digital and strategic marketing communications. She is the Head of Marketing (Europe) at Global Reviews.