A review of process and tools available for online competitor analysis

Although we know it’s important to analyse how your own website is performing in terms of visitor numbers, customer demographics and conversion rate, we should remember that it's important to look outwards too.

Competitive intelligence analysis can tell you how you are performing relative to your competitors and provide some insight into their visitor numbers, audience plus marketing and search strategies.

Effective competitor intelligence analysis can provide real actionable insights that just aren’t possible using standard web analytics tools such as Site Catalyst, Google Analytics or Webtrends. By understanding more clearly as to what your competitors are doing, you can make more insightful decisions about what to do with your online marketing activities.

Key benefits of conducting online competitive analysis

You can apply competitive intelligence analysis allows you to gain insight on:

- Consumer behaviour - Learn how your target consumers behave on the web Who - and what - are they being influenced by? And are their seasonal trends you should be aware of?

- Paid and organic search opportunities - Identify when to use paid search to supplement your organic search efforts at peak times and where you rank in comparison to your competitors for the top search terms in the market.

You can also discover what key terms your competitors are bidding on and which are brining in the most traffic and custom to their website(s).

- New business relationship opportunities - What partners and affiliates are your competitors working with? Who and what is referring the most visitors to your website?

This insight can provide you with ideas as to who you may be able to work with in order to maintain and drive more targeted traffic to your site.

Key tools for conducting competitive analysis

Effective competitive intelligence analysis isn’t cheap - but if done well it is well worth the cost. Whilst there are a number of low-cost/ free tools available, the market leaders such as Hitwise and Comscore provide excellent data and insight that no free/ low-cost alternative can rival.

Nevertheless, tools such as Google Trends, Compete and (to an extent) Alexa can provide some useful competitive intelligence insight at a much lower cost. And small businesses who may not be able to afford a full license from tools such as Hitwise can purchase custom reports for a particular set of insights.

Competitive analysis best practice process and actions

1. Industry benchmark - share of visits

A good way of getting a ‘top-level’ view of where you rank in your industry or versus a specific set of competitors is to benchmark yourself for overall visits. This can be tricky if competitors have different ranges or product categories or their business is structured different to yours, but it's usually possible to make assumptions which will help you compare.

An industry benchmark report provides a snapshot of your online performance in context with your competitive landscape.

The objective is to determine the big players and identify the ‘movers and shakers’ in your industry. Where do you rank against them? Where are there gaps that can be built on (if you’re ahead) or closed (if you’re lagging behind)?

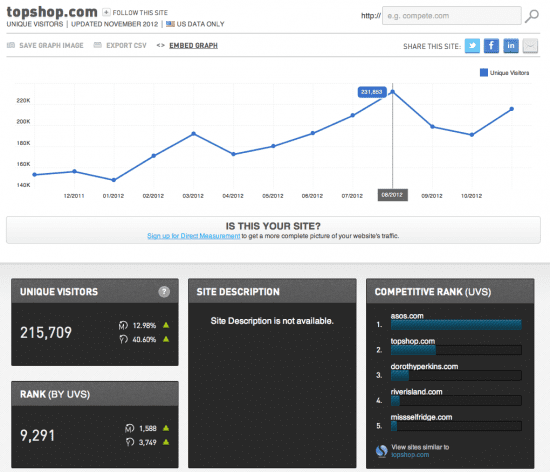

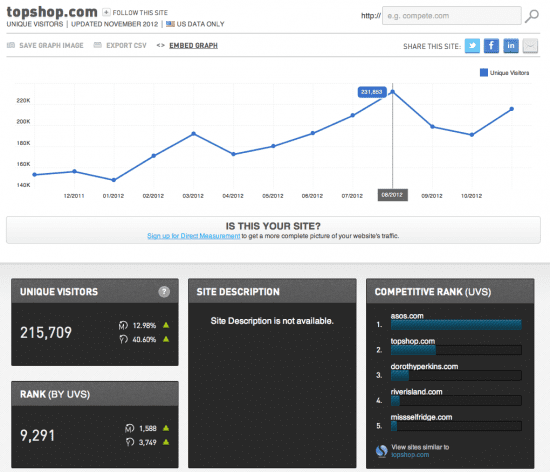

Using Compete, you can get an impression of how many unique visitors a particular website is getting and how they compare with similar sites as well as your own:

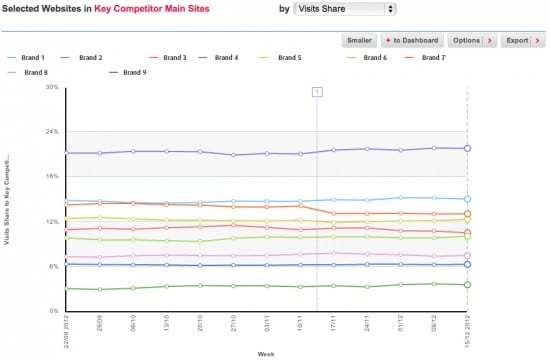

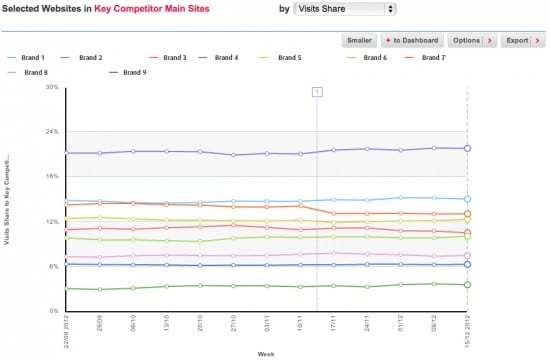

With Hitwise, you can build an even more accurate picture of where you are versus your competitors:

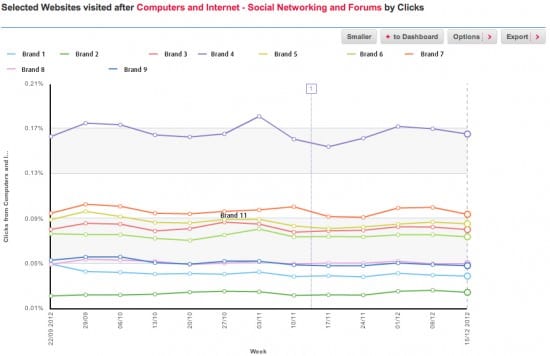

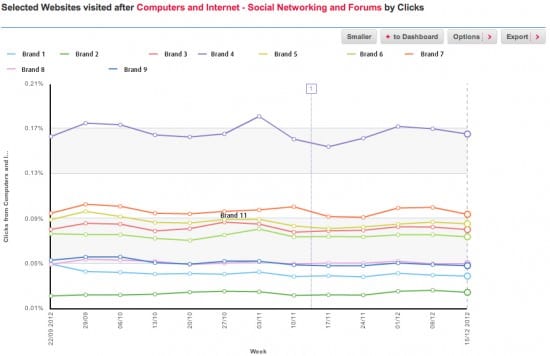

2. ’Upstream and downstream’ visits

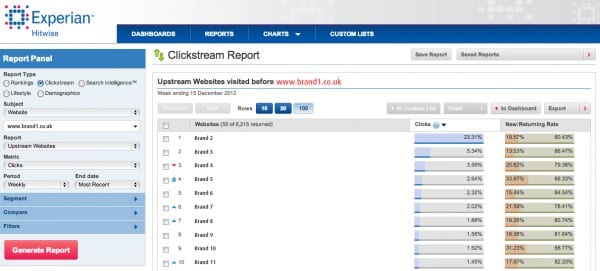

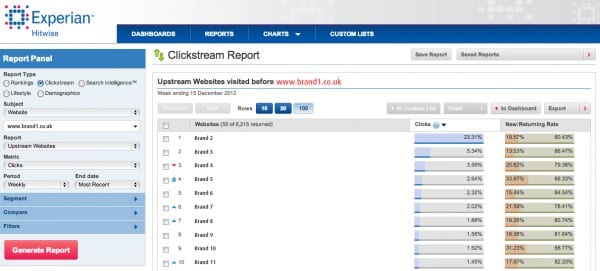

Upstream and downstream reporting allows you to form an impression of the behaviour, intention and ‘mindset’ of visitors to your website.

An ‘upstream’ report will show you what sites visitors have been to before visiting yours and shed light on the types of behaviour customers are displaying before they visit you.

However, the real benefit is in seeing where customers go before they visit your competitors.

For example, are they coming from search engines, aggregators or affiliate sites? Or are they coming from content heavy sites such as blogs or social networks? This type of insight gives you great insight into where you could be spending more time in order to connect with those potential customers.

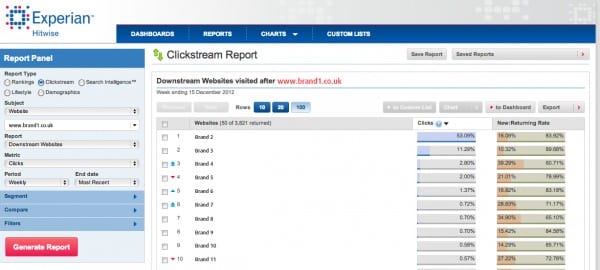

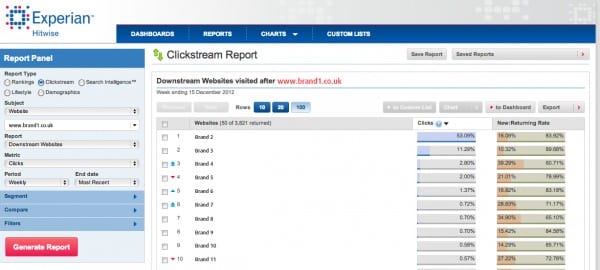

A ‘downstream’ report will show you the type of sites visitors go to after visiting yours.

For example, how many people are visiting a competitor site or a search engine after visiting your site? Perhaps your price is out of kilter or your value proposition not compelling enough? Or maybe you didn’t provide the right information and so they returned to Google to search for something else?

3. Share of search

Search engines provide the vast majority of traffic to websites. And what’s more, organic search traffic is particularly valuable as it is focused, comprising of people intent on fulfilling their research and purchasing goals.

A share of search report can give you an indication of the percentage of traffic you are getting from search engines versus your competitors and provide insight as to how effectively your SEO strategy is performing against others.

The key benefit here is that a share of search report gives you an idea of fluctuations in search activity across the industry and can provide external validation of your search efforts. For example, if you notice an increase in organic search traffic for a particular month or period of time, competitor intelligence analysis can let you know whether your SEO efforts are paying off or if you (and your competitors) are just benefiting for an industry-wide rise.

4. Key traffic drivers

What type of sites are driving the most traffic to you, your competitors or the industry as a whole? A key traffic driver report will provide insight into the acquisition strategies of your competitors and possible opportunities that you yourself may not have exploited to their full potential.

Are your competitors relying a lot on search, social media or email? Are they using a set of affiliates that you have not considered? Or are they using a set of affiliates that you use but to a much larger degree?

5. New key term discovery

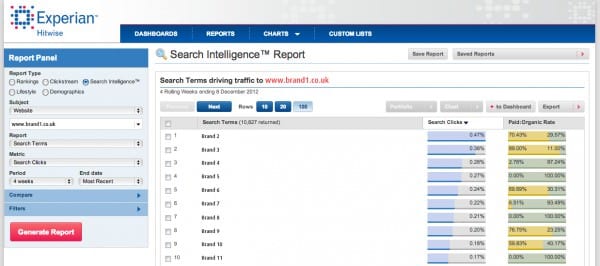

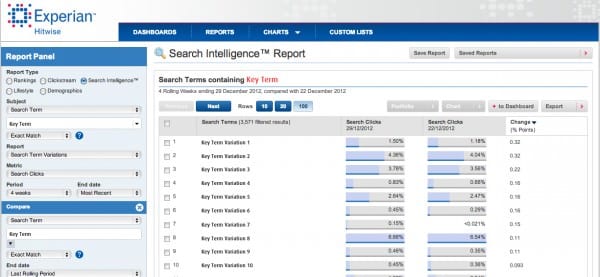

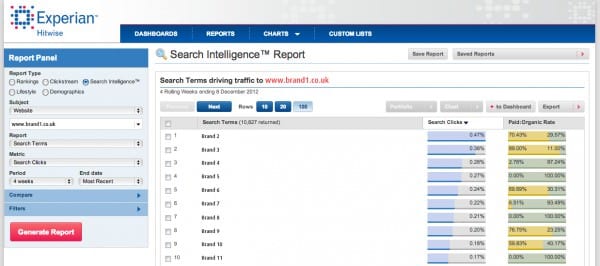

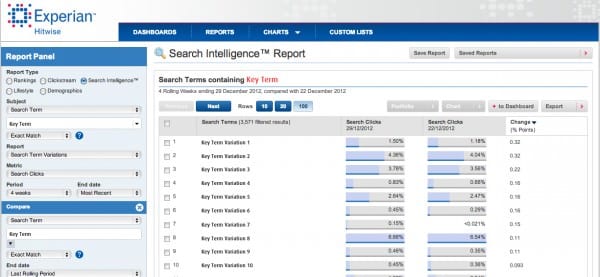

Competitive intelligence is great for discovering new key terms and phrases that you may have overlooked for your own site.

By looking at the terms driving traffic to your competitors’ sites and not yours, along with fast-moving search terms (key terms and phrases people are searching for most within a given time frame, for example the last few weeks or month) you can begin to formulate a ‘gap’ analysis.

The picture below shows a key term variation report from Hitwise. A report like this can show fast-moving phrases around a particular keyword or term.

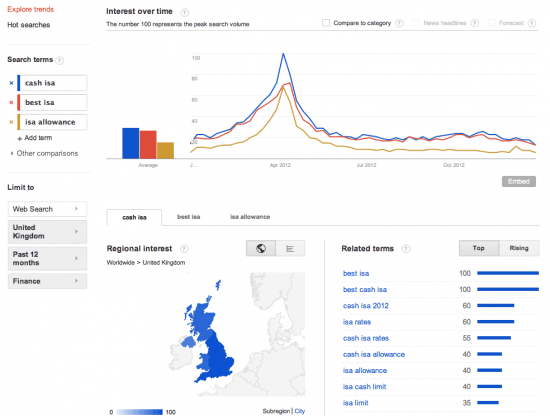

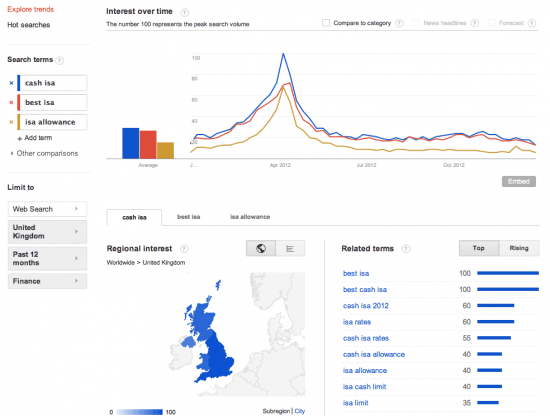

Google Trends (which now includes the features of Google Insights for Search) is a really simple, cheap and easy way to look for new key terms and their popularity relative to others. And it’s also ideal for comparing brands and products over a period of time.

In the example below, we can see the strength of three ISA related key terms over a period of 12 months in the UK.

Although each terms follows a near identical trend over a year, peaking at ISA-time in April before dropping away in May and June, this data gives a good indication as to what people were searching for in relation to ISAs in 2012 and some insight into their buying behaviour.